Question 1

Residual income is an appropriate performance measure for which type of responsibility centre?

- A. Cost centre

- B. Revenue centre

- C. Investment centre

- D. Profit centre

Answer:

C

Comments

Question 2

Which TWO of the following are examples of management information made possible by the

availability of big data?

- A. Customer profitability analysis to identify key strategic customers

- B. Customer information harvested from social media to target products

- C. Production cycle time analysis to improve production efficiency

- D. Real-time inventory management information shared with producers to influence their production plans

- E. A five year history of a company's aged debtor list to assess the long-run effectiveness of credit control

Answer:

B, D

Comments

Question 3

A very large organization is financed by both debt and equity. It evaluates all projects on the basis of

their net present value (NPV) using an organization wide weighted average cost of capital as the

discount rate.

For a small project, which TWO of the following would affect the project's cash flows AND the

discount rate?

- A. Taxation rates

- B. Inflation rates

- C. Depreciation rates

- D. Changes in working capital

- E. The project's terminal value

Answer:

A, B

Comments

Question 4

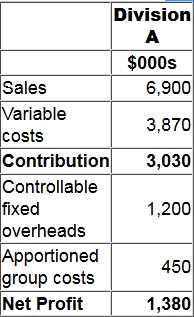

Division A is an investment centre with assets of $7.3 million. The following is an extract from the

annual budget for division A:

The cost of capital is 14%.

Calculate the residual income for division A.

- A. $808,000

- B. $1,727,800

- C. $358,000

- D. $2,008,000

Answer:

A

Comments

Question 5

One aspect of life cycle costing is the recognition of the fact that during the design or development

stage a large proportion of many products' life cycle costs are:

- A. determined

- B. wasted

- C. under absorbed

- D. amortised

Answer:

A

Comments

Question 6

A project with a 6 year life generates a positive net present value of $1,100. The discount rate is 8%.

To the nearest $, the equivalent annual benefit is:

- A. $5,085

- B. $238

- C. $177

- D. $693

Answer:

B

Comments

Question 7

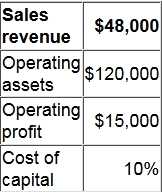

The following data are available for a division for the latest period.

What is the division's residual income for the period?

- A. 12.50%

- B. 31.25%

- C. $36,000

- D. $3,000

Answer:

D

Comments

Question 8

A company has invested $500,000 in developing a new product and requires a return of 12% on this

investment.

The company has researched the market and has set the selling price for the new product at $300

per unit. At this price, sales volume for next year is forecast to be 500 units. The forecast unit cost is

$210.

What is the target cost gap per unit for the coming year?

Give your answer to the nearest whole $.

Answer:

$30

Comments

Question 9

Which of the following investment appraisal methods provides an absolute monetary value on which

to base decisions?

- A. Accounting rate of return

- B. Net present value

- C. Internal rate of return

- D. Profitability index

Answer:

B

Comments

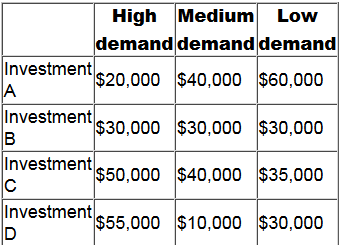

Question 10

A company is considering four mutually exclusive projects. There are three possible future demand

conditions but the company has no idea of the probability of each of these demand conditions

occurring. The forecast net present values (NPVs) of each of the four projects, under each of the

three possible future demand conditions, are as follows.

Which investment would be selected using the maximin criterion?

- A. Investment A

- B. Investment B

- C. Investment C

- D. Investment D

Answer:

C

Comments

Page 1 out of 20

Viewing questions 1-10 out of 202

page 2