Question 1

According to a decision tree forecasting, there are three possible outcomes of a project requiring

£10,000 capital investment. They are (along with probability of occurring): £20,000 in revenue (45%),

£35,000 (15%),

£10,000 (30%) and -£6,000 (10%).

However, choosing another project (2) requiring the same investment would give us £12,000 and

choosing project 3 would give us a 90% chance of generating revenues of £15,000 but a 5% chance of

revenues of £0.

Project 4 is wildly ambitious and boasts an unlikely (5% chance) of generating revenues of £100,000.

There is a 10% probability of negative revenues.

Which is the risk averse investor more likely to take?

Project 1

Project 2

Project 3

Project 4

Answer:

B

Comments

Question 2

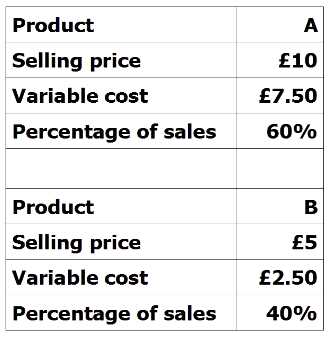

Find the weighted average contribution per unit using the following information:

- A. £10

- B. £8

- C. £5.50

- D. £2.50

Answer:

D

Comments

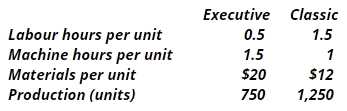

Question 3

D3 makes 2 types of toilets - the Executive (Ex) and the Classic (CI). Direct labour costs $6 per hr and

overheads are absorbed on a machine hour basis. The overhead absorption rate for the period is $28

per machine hour. What is the traditional cost per unit for (Ex) and (CI)?

- A. (Ex) 60, (CI) 56

- B. (Ex) 58, (CI) 53

- C. (Ex) 65, (CI) 49

- D. (Ex) 62, (CI) 52

- E. (Ex) 63, (CI) 48

Answer:

C

Comments

Question 4

N prepares budgets on an annual basis by using the budget from the previous year, and then

adjusting it for growth and inflation.

This is an example of:

- A. An incremental budget

- B. A rolling budget

- C. A flexed budget

- D. Zero based budgeting

Answer:

A

Comments

Question 5

What type of budget is prepared on an annual basis taking current year operating results and

adjusting them for expected growth and inflation?

- A. Rolling budget

- B. Incremental budget

- C. Flexed budget

- D. Zero-based budget

Answer:

B

Comments

Question 6

Which of the following would cause an adverse fixed overhead volume variance?

- A. Actual output was higher than budgeted

- B. Actual output was lower than budgeted

- C. Actual expenditure was higher than budgeted

- D. Actual expenditure was lower than budgeted

Answer:

B

Comments

Question 7

Which one of the following would NOT be included in a decision to close a division of an

organization?

- A. Head office overheads absorbed on the basis of the number of units produced

- B. Sale of unwanted non-current assets

- C. Redundancy pay for employees of the division

- D. Fixed costs directly attributable to the division

Answer:

A

Comments

Question 8

In short-term decision making, which TWO of the following are relevant costs?

- A. Sunk costs

- B. Avoidable costs

- C. Committed costs

- D. Opportunity costs

- E. Notional costs

Answer:

B, D

Comments

Question 9

Which of the following, regarding costing methods, is true?

- A. A company produces two products which undergo similar processes. The company has very low overhead costs. This company should consider activity based costing rather than traditional absorption costing to ensure that its pricing decisions are more accurate.

- B. A company which has introduced technology to reduce labour costs now incurs a greater proportion of non volume-related support activities. Activity based costing would be more appropriate than traditional absorption costing in this environment.

- C. A company is making short term decisions based on the contribution per unit of its different products. These decisions are based upon full absorption costing data.

- D. In traditional absorption costing, overheads are charged to a product by absorbing them at the cost driver rate for an activity based on their usage of the activity.

Answer:

B

Comments

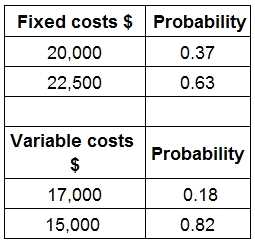

Question 10

GP is launching a new product. The annual forecast costs are as follows:

What is the expected value of the total costs?

Give your answer to the nearest whole $.

Answer:

$36935

Comments

Page 1 out of 25

Viewing questions 1-10 out of 260

page 2