Question 1

Newsweb

Wodd and Darrell announce plans for restructuring

True to form, the ink was barely dry on the last contract before the corporate restructuring experts

arrived to "counsel out" the staff who have become "surplus to requirements". Wodd and Darrell

have still to agree on a new name for their merged entity, but they have already announced the need

for "efficiency savings". The first redundancy notices have already been issued and many more are

expected to follow over the next few weeks.

Answer:

Complete

your answer and

submit.

Comments

Question 2

You have received the following email from Marcus Svenson, Finance Director:

From: Marcus Svenson, Finance Director

To: Senior Finance Manager

Subject: Biomass proposal

Hi,

The Board has just heard a presentation by an engineering consultancy concerning a proposal to

develop a biomass power station adjacent to our North Forest.

The Board has asked us to put together some thoughts about the merits of this proposal. We would

proceed on the basis that we would build the power station and sell the resulting electricity to the

national power generator which has a number of coal-fired power stations, each of which is nearing

the end of its useful life and the coal has to be shipped in, so we should find it relatively easy to

guarantee sales. The power generator has indicated that it would be possible to negotiate a three

year contract in the first instance, with the expectation that this would be extended by subsequent

three year contracts, subject to price and performance.

We would be responsible for building and operating the power plant and we would also have to pay

for 50% of the cost of power lines for connecting to the national electricity grid, with the other 50%

being funded by the national power generator.

Please draft a briefing paper that I can present to the Board on the following:

How can we predict whether the share price is likely to increase or decrease if we commit ourselves

to this project? You should identify the challenges associated with answering that question and

indicate how we might address them.

What are the long-term risks associated with future revenues from the sale of electricity? How might

we manage these?

Marcus

Reference Material:

Answer:

Complete

your answer and

submit.

Comments

Question 3

Six months have passed. Wodd has announced its intention to create a biomass power station in its

North Forest, to be fuelled by trees from the North Forest itself and also waste biomass products

from other timber land owned by Wodd in that area.

The news has received mixed reactions. Younger residents of the small towns close to North Forest

were delighted because their local economy will be boosted. Older residents and those living further

afield within the region complain that the power station will pollute the environment and the

destruction of the North Forest will blight an area of outstanding beauty. A residents’ group has been

established online, with support from Marland’s largest environmental lobbying group, to block the

proposal.

You have received the following email from Marcus Svenson, Finance Director:

From: Marcus Svenson, Finance Director

To: Senior Finance Manager

Subject: Stakeholder issues

Hi,

I have sent you a link to the website created by the protestors against the biomass power station.

This is causing serious problems because we still need to gain formal Government approval, although

the Government supports biomass as an energy source as it is far cleaner and more sustainable than

fossil fuel and far less controversial than nuclear. Needless to say, the press has picked up on this and

is starting to run the story.

We had reached agreements in principle with Marland Bank for funding for this project and with a

civil engineering contractor for the construction work, but both are now nervous about signing

contracts because neither wishes to be associated with an environmental scandal.

I need two things from you.

Please draft the body of a press release that we can issue in response to the claims on the protestors’

website. Add a few comments to explain what your arguments are trying to achieve (I don’t want us

simply to state that we disagree with the protestors, I want us to offer meaningful arguments in

response). Just write your draft as part of your reply to this email and I will circulate it to the other

Board members for approval before we submit it.

Please suggest some safeguards that we can put in place to enable us to retain the support of the

bank and the civil engineer throughout this project.

Marcus

Answer:

Complete

your answer and

submit.

Comments

Question 4

Save North Forest!

North Forest is located in an area of outstanding natural beauty that also includes a number of small

towns and villages. Many local residents moved into the area after retiring and were attracted by the

opportunity to breathe fresh air and be surrounded by beautiful views. In doing so, we have brought

wealth into a local economy that was struggling because there was little employment to encourage

younger people born in the area to stay.

Wodd plans to destroy North Forest in order to fuel a power station that will, in itself, spoil the view

as well as polluting the atmosphere.

Globally, vast areas of forests are cleared every year for commercial exploitation. This creates untold

risks for the planet because trees are responsible for giving us breathable air.

Local residents are working together with Green Marland, Marland’s largest environmental

campaigner, to draw attention to the damage that Wodd is threatening to inflict on this area.

We ask you to write to the Government planning department to ask it to refuse to issue a permit for

this development. We also ask you to sign our online petition and to consider joining us in peaceful

and non-violent direct action against the bulldozers in the event that our efforts to block the granting

of a Government permit should fail.

Answer:

Complete

your answer and

submit.

Comments

Question 5

Two months have passed since the threatened disruption of the building work on the biomass power

station. The threat has been resolved and work is again under way on the development.

You have received the following email from Peter Sorchi, CEO:

From: Peter Sorchi, Chief Executive Officer

To: Senior Finance Manager

Subject: Wildlife survey

Hi,

I tried to obtain some trustworthy advice from your boss this afternoon, but have come away feeling

quite unsure that we are on the same wavelength.

As you know, the law in Marland is very clear concerning the protection of rare species of wildlife.

Before building work commences on our new power station the Government will send a survey team

to check for the presence of protected species. The attached article shows how sensitive an issue this

can be.

As part of our corporate social responsibility, every one of Wodd’s forestry teams has a small team of

wildlife officers, whose job is to survey the forest and to identify all natural habitats. Trees can grow

undisturbed for many years in a commercial forest before they are harvested and so natural habitats

can become well established. Our wildlife surveys enable us to limit the harm done when trees are

felled.

One of Wodd’s wildlife officers in the North Forest has submitted a report on the sighting of a rare

species of bat in the area that will be cleared for the power station. The report states that these

creatures tend to be difficult to observe because they only come out very late at night and tend to

roost in dense forest. This could, potentially, delay the start of work for six months while the bats are

captured and relocated. Relocating the bats will also be expensive.

The Finance Director’s advice was to ask the wildlife officer to change the report, stating that the

original version was submitted in error and that the sighting occurred in a completely different part

of the forest, well away from the planned construction site. There is only a small possibility that the

Government inspectors will find the bats during their own inspection. In the event that they do then

Wodd can claim that it was unaware of the bats’ presence.

This whole exchange raises a number of issues for me.

Should we spend shareholder money on protecting wildlife in our forests?

What are the implications for our internal control system of the Finance Director

asking for this report to be changed?

What are the difficulties in motivating our wildlife officers and how might we

overcome these?

The Chairman is always complaining about how the executive directors are too

aggressive when it comes to making a profit. How might I address that concern?

I would appreciate your response on each of the above issues.

Peter

Answer:

Complete

your answer and

submit.

Comments

Question 6

You have received the following email from Peter Sorchi, CEO:

From: Peter Sorchi, Chief Executive Officer

To: Senior Finance Manager

Fwd: Tax avoidance article

Hi,

I am forwarding you an email from a journalist. It came in via our press office, who passed it up the

management chain and it ended up in my inbox.

Some of the basic facts stated in the draft article are correct:

We do have arrangements in place with leading tax advisers for referrals of potential

clients. We pay a commission for all such referrals, which the tax adviser is required to disclose to the

client.

Barry Crauder has been one of our largest clients for many years. He owns significant

forested land and we manage that in return for our usual fee.

We do not offer tax advice, or promote forestry as a tax-efficient investment. We

simply offer a forestry management service as a paid service.

I would like you to address the following issues and I need your reply as a matter of some urgency.

Could we be accused of behaving unethically with respect to this aspect of our forestry management

service?

Please draft a response that we can submit to Sonia Jones. Please also give an explanation for the

Board as to how you will address the fact that the draft newspaper article clearly makes us appear to

be unethical. We will consider your draft and related comments at a meeting this afternoon, before

submitting anything.

Peter

To: Press Office, Wodd

From: Sonia Jones, reporter, Daily Gazette

Re: Tax avoidance article

I am seeking a response from Wodd concerning the activities of the celebrity Barry Crauder. We have

established that Mr Crauder has been investing heavily in forestry in order to avoid paying tax on the

considerable wealth that he has amassed from his show business career.

We believe that a significant part of this story is the relationship between forestry companies such as

Wodd and professional tax advisers. When researching this story I posed as a wealthy investor and

approached several firms that specialise in offering tax avoidance advice to high net worth

individuals. Four of the firms whom I approached recommended a forestry scheme and specifically

recommended Wodd to manage it for me. I believe that Wodd has a close relationship with these

firms and possibly others.

I have attached a draft of my story. I have sufficient evidence to support every fact stated. I am

writing in order to give Wodd the opportunity to respond if it wishes to do so, although the story will

run regardless. I will require your comment within 48 hours, otherwise, I will run the story as it

stands.

Sonia Jones

Chief reporter, Daily Gazette

Answer:

Complete

your answer and

submit.

Comments

Question 7

Daily Gazette

Draft story for comment

The singer, the forester and the tax adviser

Popular singer Barry Crauder is regarded as one of our more financially-aware personalities. He

works hard, releasing at least one new album every year and serving as a judge on a popular talent

show. He has a reputation for investing this income wisely, choosing to save for his future rather than

squandering on the trappings of the show business lifestyle.

Crauder’s popularity was severely damaged when it emerged that he pays little or no tax on the

investment income derived from his portfolio of investments. That is because he has used one of the

few remaining tax loopholes, namely investment in forestry. He owns significant areas of forestry in

the far North of Marland. We estimate his earnings from those investments to exceed M$800,000

every year and yet he has not paid a single Cent in tax on that income since he first invested in

forestry ten years ago. In contrast, a typical fan who earns the national average wage of M$28,000

every year will pay approximately M$7,000 in tax.

So, could we all invest in forestry? Well, not unless we can afford it. I posed as a wealthy business

entrepreneur and approached several leading tax advisers. Most were interested in helping me to

invest a seven figure sum to avoid tax, but warned that saving tax could be expensive in terms of fees

and commissions.

Four firms recommended forestry as the ideal investment. All recommended Wodd, with whom all

four claimed to conduct "significant business". They said that a typical client would give Wodd a bank

draft and leave the purchase and subsequent management to Wodd in return for a fee. Most clients

had never even seen the forests that they own and none ever need to make a management decision

concerning the growth or sale of timber.

Sadly, investing in forestry is a rich person’s pursuit. I was warned that companies such as Wodd are

unlikely to entertain a potential client whose initial investment does not run into the tens of millions

of M$.

Please address any response to Sonia Jones, care of the Daily Gazette news desk, as quickly as

possible.

Answer:

Complete

your answer and

submit.

Comments

Question 8

Two weeks have passed since the article about Wodd’s role in tax avoidance was published.

Thankfully, the initial reaction was to condemn the celebrities who invest in tax avoidance and little

was said about Wodd’s role in facilitating tax-efficient investments.

You have received the following email from Sarah Johns, Marketing Director:

From: Sarah Johns, Marketing Director

To: Senior Finance Manager

Subject: Forestry certification

Hi,

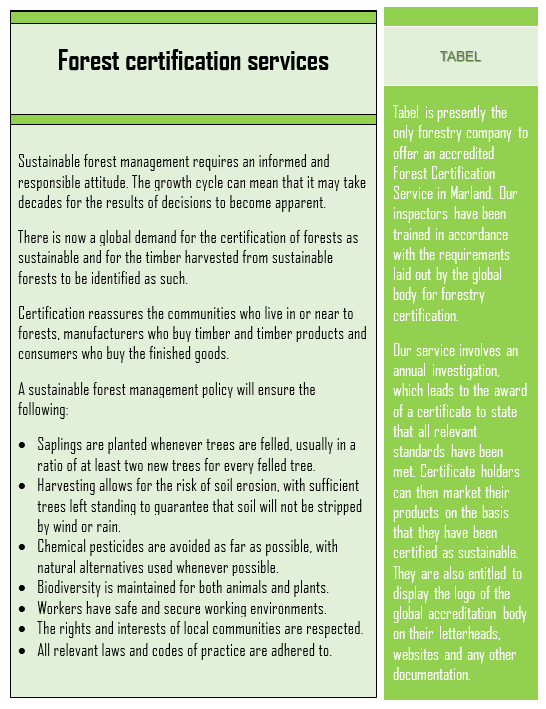

I am told that you would be a good person to talk to concerning the practical implications of a new

venture that has been proposed.

I have attached a sales brochure that I downloaded from Tabel’s website. Tabel is a competing

forestry company that has similar interests to our own. It has recently launched the certification

scheme that it has described in its brochure. It has no competition for this certification in Marland

because no other company has sought the qualifications required to offer an accredited Forest

Certification Service.

Wodd has the necessary skills to offer a credible Forest Certification Service. Our forestry managers

already aim to exceed all of the requirements set out by the global body. We also have a well-

resourced internal audit department. I believe that we could transfer either forestry managers or

internal auditors to a new external certification department. The transferred staff would complete

the training required by the global body and would sit the associated examinations. We could then

compete with Tabel’s service.

I need your advice on the following:

Could you explain how you imagine that a typical certification investigation would work and the skills

that it would require? That will help us to decide whether to approach forestry managers or internal

auditors and will also enable us to describe the work that they would be doing if they agreed to be

transferred.

What are the challenges associated with motivating and evaluating the investigators in the

certification service and how might we address these?

Sarah

Reference Material:

Answer:

Complete

your answer and

submit.

Comments

Question 9

A further eight weeks have passed since the discussion concerning Wodd’s creation of an accredited

Forest Certification Service.

Wodd’s Chairman has asked you to a meeting:

"I thought that we had a lucky escape over the Barry Crauder story from a recent news article, but

the Government is considering modifying the tax arrangements associated with forestry. Professional

forestry companies such as Wodd will continue to pay no tax on forestry profits, but private

individuals such as Mr Crauder will be taxed on profits just as they would for any other business. The

Government is taking this action because public opinion is against granting generous tax relief to

wealthy individuals.

For the moment, this is all highly secret. The minister responsible for forestry has spoken to the

chairmen of all of the major forestry companies on the basis that each gives a personal guarantee to

respect the Government’s confidence. The minister has done so because she is concerned that stock

markets will panic when the news of the tax changes are announced next week. If the shareholders

incorrectly believe that we will lose the tax shield on our profits then the share price will drop like a

stone. We will be able to announce that we are aware of the changes and that we will not be taxed

differently because of them.

I have spoken to the Board about this, making them promise not to repeat any of this information.

We have called in and briefed the key analysts who advise the main institutional investors in Marland

on the forestry industry.

As things stand, we can expect a lot of the wealthy individuals who own forests to divest themselves

as soon as they discover that there are no more tax incentives. That will have significant implications

for Wodd, both directly and indirectly.

The Board believes that the markets will overreact when the tax changes are first announced and

that we will be unable to do much to manage that. One suggestion that has been put forward is that

we should increase the dividend slightly as a signal that we are confident in the future strength of the

industry. I suspect that the executive directors are just a little too concerned with the fact that they

all have stock options that can only be exercised on a date that falls just after the government is due

to announce its intentions on tax.

I need your thoughts in order to have an independent viewpoint from that voiced by the Board:

What effect will the tax changes have on our business?

Do you agree that briefing the analysts will mitigate the risk of our share price

overreacting when the tax changes are announced?

Will the additional dividend payment help to maintain the share price?

Is granting executive stock options always a sound basis for aligning the interests of

the executive directors and the shareholders?"

Answer:

Complete

your answer and

submit.

Comments

Question 10

Daily Gazette

Celebrities flock to release tax returns

Comedian Madd Wilkins is the latest celebrity to post his tax returns online. The comedian earned

M$1,600,000 from his sell-out tour and from the sale of DVDs. He paid tax of M$608,000 on that

income. The comedian quipped, "there’s nothing funny about paying tax, but then there’s nothing

very funny about my act either so it’s only fair that I should pay the full whack".

Public concern about the tax benefits enjoyed by wealthy celebrities using artificial schemes such as

investing in forestry to minimise their tax bills has led to closing tax loopholes topping the political

agend

a. Many wealthy individuals have volunteered their tax files in order to reassure the public that they

are not benefitting from such schemes.

Answer:

Complete

your answer and

submit.

Explanation:

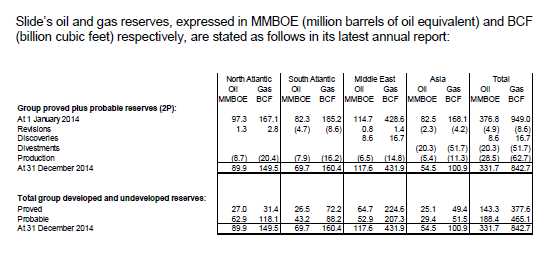

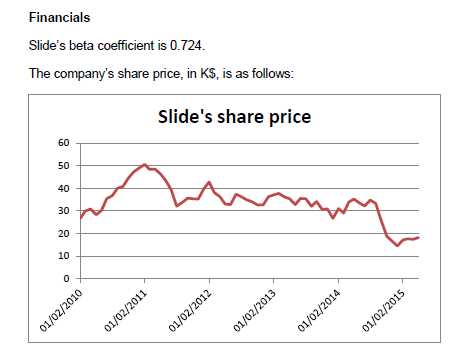

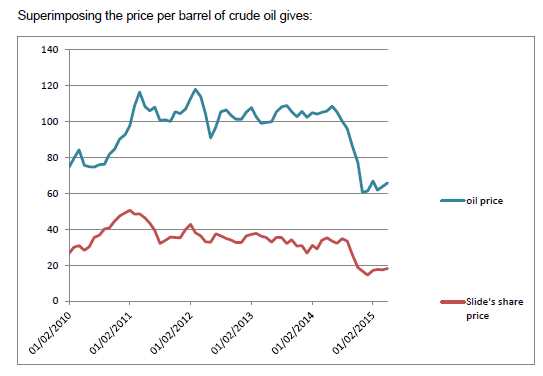

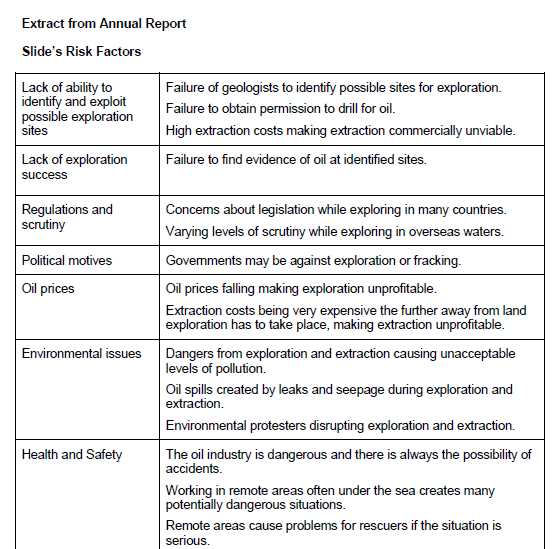

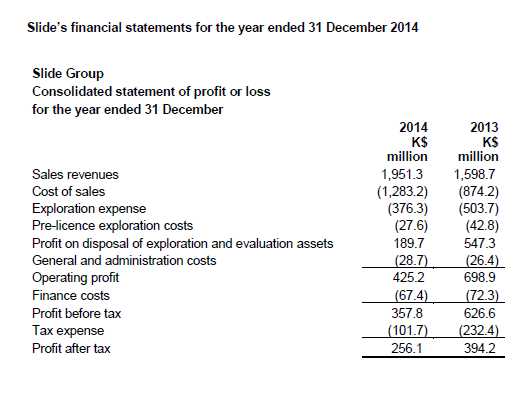

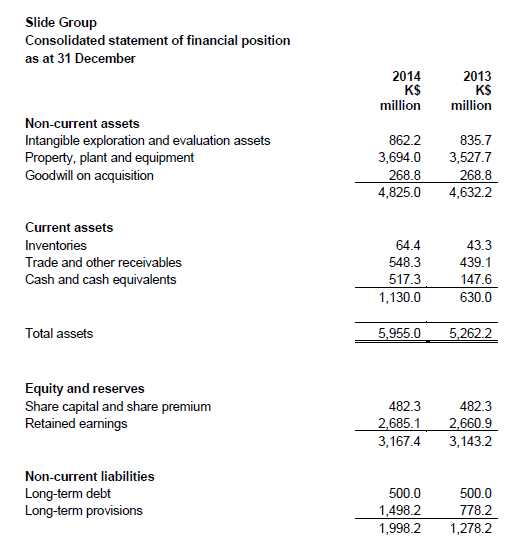

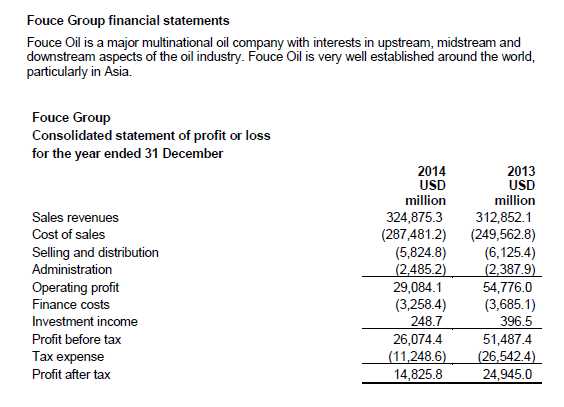

Topic 2, Slide Company

Pre-seen case study

You are a senior Finance Manager who works for the Slide Group (‘Slide’). You report directly to the

parent company’s Board and advise on special projects and strategic matters. You have compiled the

following facts about the company.

Slide – company background

Slide was founded in 1954 by Henry Jones. His family owned a large piece of land on a Caribbean

Island and a chance discovery revealed the possibility of oil deposits under that land. The family

registered Slide as a company to raise finance in order to explore this opportunity and the

subsequent find exceeded all expectations.

The success of this first venture encouraged the Jones family, who owned 75% of Slide’s equity

shares at that time, to purchase oil exploration rights and to conduct exploratory drilling. The

company soon developed considerable expertise in the successful purchase and exploitation of

exploration rights.

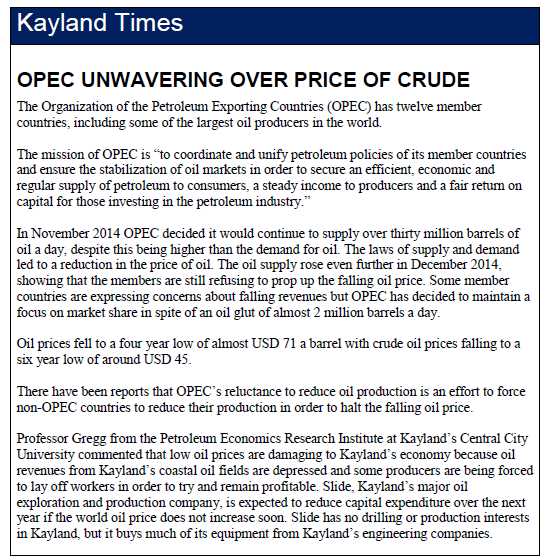

Henry Jones’ family lived in Kayland, a European country. Slide was listed on Kayland’s stock

exchange in 1965. Henry Jones was Chief Executive Officer (CEO) of Slide until 1976. He was replaced

by his son, Michael, who served as CEO until 1998. Michael’s nephew, Andrew Jones, took over and

continues as CEO.

Over the years, the ownership interest of the founding family has declined. Some of their shares

were placed on the stock exchange when the company was first listed. Since then, various holdings

have been sold. By 2015, Andrew Jones retained 10% of the issued equity and a further 8% was

retained by a number of other relatives.

Fouce Oil, an Asian company based in Country C and listed on C’s stock market, purchased 25% of

Slide’s equity in 2010. At the time, Fouce Oil made a formal public announcement that it would not

purchase further equity shares in Slide. In response to this assurance, Fouce Oil has the right to select

two Non-executive Directors to serve on Slide’s Board.

The Slide Group has wholly owned subsidiaries operating in seven countries around the world. Each

subsidiary is responsible for acquiring oil exploration rights in its host country and arranging for the

necessary work to be undertaken in order to explore for oil.

Kayland’s home currency is the K$.

The oil industry operates on a global basis and virtually all transactions are priced in terms of United

States Dollar (USD). Strategic case study exam – May 2015 – pre-seen materials

3 ©CIMA 2015. No reproduction without prior consent

Oil Exploration

Crude oil is created by natural processes. Organic matter that is trapped underground and

compressed while it decomposes can form pools of crude oil over a period of millions of years. The

time taken for oil to be created through this process means that it is effectively irreplaceable once it

has been extracted and consumed.

Natural gas is formed by the same process. Oil wells often have a pocket of gas trapped above the

well. The pressure from the gas can be used to force oil to the surface once a well has been drilled

into the rock.

Natural gas can be collected and distributed as a fuel or it can sometimes be regarded as a by-

product of oil.

The process of searching for oil requires an understanding of geology. Geologists have discovered

that certain types of rock formations are associated with the presence of oil. Geologists conduct

surveys that include the analysis of the fossils that can indicate that an area was once rich in the

plant and animal life that could have provided the organic matter required for the creation of oil.

Oil fields can be discovered on land or under the sea. Exploration and drilling for oil is possible in

either setting, with each offering its own challenges.

If an oil company believes that an area is worth exploring then it must seek permission from the

owner of the mineral rights, who is not necessarily the owner of that land or stretch of water at

surface level. In some countries the government owns all mineral rights. In other countries it is

possible for the surface land and the mineral rights to be owned by different people or entities.

Mineral rights at sea generally belong to governments. The law relating to ownership of minerals

under the sea can be complicated and national rights can be a matter for international law, with

some countries’ rights extending hundreds of miles from the shoreline and others being quite

restricted.

Onshore oil drilling rig

Oil companies often supplement the geological surveys with seismic surveys. These involve creating

a loud bang by generating a small explosive charge. The resulting sound waves penetrate the rock

layer and create echoes, which are recorded for detailed analysis. The echoes can indicate a great

deal about the conditions under the rock, including the possible presence of oil.

Seismic survey ship

Ultimately, the only way to ensure that there are exploitable quantities of oil in a particular site is to

drill an exploratory well. On land, this would involve building a drilling rig in place. At

sea, this would require the use of a special ship or drilling rig that would be anchored in place during

drilling operations. Drilling is always expensive and there is always a risk that the well will either turn

out to be dry or to contain too little oil to be worth extracting.

The viability of an oil well can be affected by the price of oil. When oil prices rise it can become

financially viable to spend more on extraction and transportation from a well that was previously

classed as marginal or even unproductive.

If suitable oil reserves are found then the drilling rig is replaced by a production rig that is equipped

to bring the oil to the surface and to pipe it to storage tanks or pipelines so that it can be collected

and taken to the refinery.

Crude oil must usually be refined before it can be used. The only major exception being that some

oil-fired electrical power stations can burn crude oil as fuel.

Oil refinery

Crude oil is a mixture of different grades of hydrocarbon. These can range from light and volatile

fractions such as aviation fuel and petrol to heavier fluids such as diesel fuel and lubricants right

down to heavy tars and bitumen. Refining involves separating crude oil into these different grades.

Each oil field has its own unique mixture of different fractions, which affects the price.

For historical reasons, quantities of oil are measured in terms of ‘barrels’. A barrel of oil is equivalent

to 42 US gallons, which is roughly 159 litres. This measure dates from the times when oil was shipped

in barrels, but this is no longer the case with the advent of pipelines and tankers.

The following information is extracted from Slide’s corporate website:

Slide’s business strategy

The oil industry distinguishes ‘upstream’ activity from ‘midstream’ and ‘downstream’.

Upstream activities involve exploring for oil or gas and bringing potentially productive wells into

production.

Midstream activities deal with the transportation of oil or gas to the refinery.

Downstream activities comprise the refining of the oil or the purifying of the gas and its subsequent

distribution and sale to customers.

Slide’s principal interest is in upstream activities. The company employs a number of leading experts

in identifying suitable opportunities for the detection of exploitable oil reserves. It has developed its

own models for the discovery of oil in areas that were previously considered to be of limited interest.

As a result, Slide often operates in areas where there is limited competition for exploration rights.

Slide is also good at finding ways to exploit marginal wells that other companies would regard as

potentially unprofitable.

Once Slide has brought a well to production then it will sell the resulting crude oil downstream, but it

tends to sell most of its oil wells so that it can release resources from operational wells and

concentrate on fresh discoveries. Slide views its strengths as being upstream and so it leaves the

midstream and downstream aspects of the industry to larger and more general oil companies.

Slide normally buys exploration rights to investigate on its own account. Slide also makes use of the

arrangements to farm-out or farm-in exploration rights.

Farming-in and farming-out are common practices in the oil exploration industry. An oil company can

farm-out by granting another company an agreed share of the revenues from a well. It may do so in

return for a cash payment, but it is also quite common for the counterparty to this arrangement to

offer a particular service instead, such as agreeing to conduct the seismic survey of the area. This

means that both companies share the risks. The farm-out arrangement also means that there is less

need to fund the costs of exploring and so cash flow is maintained.

A company might decide to farm-in as a speculative venture in order to participate in a successful

exploration, or it may offer to farm-in on condition that the primary owner makes use of facilities

that it owns, such as infrastructure to support exploration or midstream activities. For example, the

company that decides to farm-in may make it a condition that the venture uses a particular

subcontractor, in whom it has an interest, to provide the drilling equipment.

Oil companies often rely heavily on specialist subcontractors to supply equipment and operators.

That may be because some companies operate in a variety of remote locations and it is cheaper to

lease equipment that is already in that geographical region. There can also be a need for specialist

skills in operating in particular climatic conditions or on particular geological structures.

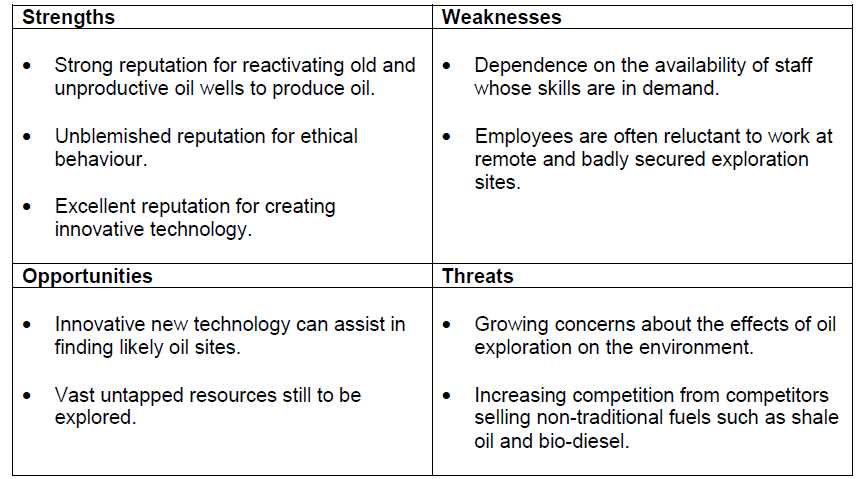

Slide’s strategy

Slide’s main strategic priority is to maintain market dominance and become the world leader in oil

exploration. The company requires continuing investment in new technology and in skilled

employees.

Slides’ directors have prepared the following outline SWOT analysis:

Mission

Slide aspires to become the most successful oil exploration company in the world, while contributing

to the wellbeing of people and the environment.

Slide’s strategic objectives for 2014/15 are:

Deliver a sustainable business

Focus on exploration led growth

Continue to investigate areas for fracking overseas

Complete 2015 operations safely and without significant negative environmental impact

Maintain a balanced portfolio

Hold a balanced asset portfolio

Maintain strong financial statements

Seek growth

Continue to investigate areas for exploration and diversification

Our Goals

Summary of 2014/15 goals:

Deliver a sustainable business

Preserve cash for future investments

Maintain a balanced portfolio

Grow the reserves and resources base to provide the funding for future growth and cash flow

Seek operational excellence

Continue to improve on our operational efficiency

Fracking

Shale rock is found deep underground. This rock contains natural gases and crude oil. Advances in

technology over the last ten years have meant that this oil and gas can be extracted from deep

underground, even if the shale rock is in a populated area, including formations that extend

underneath towns.

In the USA more than a quarter of all gas production comes from shale rock.

Extracting these minerals involves a process called ‘fracking’. Fracking breaks up the shale rock,

which releases the oil and gas. Water mixed with sand and chemicals is forced into the rock so that

the oil and gas can seep out and be collected.

The oil and gas industry has dismissed claims that fracking is bad for the environment, although it is

unlikely that the effects of the process are fully understood. One concern is the volume of water

which is required in order to force the water mixture through the rock, another is whether the whole

process could affect the stability of the surrounding rock. The oil and gas companies themselves

admit in their annual reports that fracking is associated with risks of leaks, spills, explosions and

environmental damage.

Widespread use of fracking has reduced the pressure on the USA to import oil and gas. Gas prices, in

particular, fell in the USA over the past decade. The price of oil has taken longer to respond to this

new source, but recent decreases in oil prices have been attributed in part to the flow of shale oil. Oil

and gas from this source has been a huge source of revenue in the USA.

Kayland’s government has been reluctant to allow widespread fracking due to uncertainty over the

long term effects, but is interested in the potential revenue stream that could be obtained if fracking

was successful. There have been protests outside the offices of many of the larger oil and gas

companies because environmentalists claim that the ecosystem is being damaged by fracking and

that the long term effects are unknown. However, Kayland’s government has issued some licenses in

recent months to large oil and gas exploration companies.

Oil and Gas Reserves

The most commonly accepted definitions of oil reserves are based on those approved by the oil

industry in 2007. There are two major classifications of reserves: proven and unproven.

Proven Reserves

Proven reserves are those reserves claimed to have a reasonable certainty, at least 90% confidence,

of being recoverable under existing economic and political conditions, with existing technology.

Industry specialists refer to this as “P90” or “1P”.

Unproven reserves

Unproven reserves are based on the same type of geological data that are used to estimate proven

reserves. However there are technical, contractual, or regulatory uncertainties that prevent the

reserves being classified as proven. Unproven reserves are useful for oil companies for future

planning purposes. There are two classifications for unproven reserves, probable and possible.

Probable reserves are reserves which have a 50% confidence level of recovery. The oil industry refers

to them as "P50" as they have a 50% certainty of being produced or 2P (proven plus probable).

Possible reserves are reserves that have a less likely chance of being recovered than probable

reserves. These reserves usually have at least a 10% certainty of being produced and are known as

"P10" or “3P” (proven plus probable plus possible). Two of the reasons that reserves could be

classified as possible are geologists not agreeing on the likelihood of oil and reserves not able to be

produced at a commercial rate.

By definition, a reserve must meet four criteria:

1. Discovered – one or more exploratory wells must have been drilled to confirm that oil is actually

present.

2. Recoverable – there must be sufficient oil present to make extraction a realistic possibility.

3. Commercial – there should be a firm intention to extract the oil, thereby indicating that it can be

recovered and transported from its present location.

4. Remaining – remaining reserves are technically capable of extraction and their potential extraction

is deemed profitable.

For example, it would be possible to be certain that there is a reservoir of oil in a particular location,

but for that oil to be inaccessible using current technology or it could be accessible, but the cost of

recovery could be excessive for the quantity of oil.

Accumulations that are known, but that cannot be recovered because of commercial considerations

are known as ‘contingent resources’ and are not included in reserves.

Accumulations that are thought to exist and to be potentially recoverable but that have yet to be

discovered are known as ‘prospective resources’.

Slide’s corporate social responsibility statement

Protecting the environment is a key issue for Slide. Slide is an enthusiastic supporter of sustainable

development in the oil and gas industry. Slide is determined to use natural resources efficiently while

reducing carbon emissions in order to minimise the impact on the environment while still meeting

demand for energy.

Climate change and the protection of the environment continue to be among key sustainable

development issues in the oil and gas industry. The industry is focused on efficient use of natural

resources, the reduction of carbon emissions, and mitigating the impact on the environment while

meeting the world’s growing energy needs.

We are concerned that oil leakage and seepage can affect people, wildlife and fish near our sites and

work hard to reduce the risks to them. We constantly monitor the environment close to our sites and

take immediate action if there are traces of oil found in the surrounding area. We have reduced the

number of instances of this problem and last year were pleased to note there were no reported oil

leaks caused by our exploration or extraction that required treatment. We are proud of our

reputation in the oil industry for caring for the environment.

Carbon emissions are a huge concern for Slide and we make efforts to report these in our annual

report and to reduce them each year. We have spent over K$5 million on a new data collection

system which will enable us to more accurately measure carbon emissions.

Many of the processes utilised in extraction and production use water which is a scarce resource in

many countries. In order to avoid depleting this resource we have taken steps to ensure, whenever

possible, that we recycle water and use that in our processes. We also support a charity which helps

to provide fresh water in rural areas in some of the areas of the world most affected by water

shortages. We provide expert advice from our engineers and geologists as well as practical assistance

and donations.

Slide is most concerned for the health and safety of the workforce and others who live close enough

to be affected by our processes. We are constantly looking at the health and safety risks and

updating our mitigation procedures to reduce accidents and increase our response to them. This is

one of our highest priority risks as extraction and exploration is carried out in remote areas which

can be difficult to reach. We have spent over K$10 million on training for medical and rescue teams

in order to ensure assistance is available for both minor and major issues. Strategic case study exam –

May 2015 – pre-seen materials

16 ©CIMA 2015. No reproduction without prior consent

Slide’s Board of Directors

Andrew Jones, Chief Executive Officer

Andrew is a member of the founder’s family and took over the position in 1998.

Andrew is an Oil and Gas Engineer with a Masters degree in Oil and Gas Engineering. He also has a

Master in Business Administration degree from a well-known university in the United States.

Andrew has been credited with driving the company forward to explore for oil in very remote areas

with great success.

William Seaton, Finance Director

William has been the Finance Director for six years.

William is an accountancy graduate and is a professionally qualified accountant. He has held senior

positions in accounting and finance at two oil exploration companies and was the Finance Director of

a large oil company in Africa before he joined Slide as Finance Director.

Vickram De, Director of Innovation

Vickram serves as Director of Innovation and has held this position for two years.

Vickram has a Master of Science degree in Geology and Oil Engineering Design.

Vickram has introduced many innovative ideas for oil extraction which have helped Slide become a

leader in innovative practices in the oil industry. His techniques have enabled Slide to buy

unproductive wells from other oil companies cheaply and use Vickram’s system of pumping water at

high pressure into dormant wells to force oil to the surface. His techniques are widely used in the

industry now but he has improved them significantly lately so we are still the leader in the field.

Wilma Descouteau, Extraction Director

Wilma has been Slide’s Extraction Director since 2008. She has a PhD in Oil and Gas Engineering. She

was a senior Project Manager in several large extraction projects over a period of eight years. She

was a Project Manager with a large French refinery for the previous five years and before that

worked in oil extraction projects in the North Sea off the shores of Scotland for six years.

Victor Bogdanovitch, Exploration Director

Victor Bogdanovitch has been Slide’s Exploration Director for four years. Victor has a Master of

Geology degree from a major Russian university. He worked in oil exploration in Siberia for ten years

before he joined Slide in 2007.

Victor joined Slide to look for potential exploration sites as he had been successful in his previous

company and had successfully managed a significant project to explore and extract oil off Siberia. He

was made a Director after finding and managing a successful site with huge proven reserves for Slide

in 2009. Strategic case study exam – May 2015 – pre-seen materials

17 ©CIMA 2015. No reproduction without prior consent

James Peterson – Non-executive Chairman

James Peterson has been Slide’s Non-executive Chairman since 2013. He was previously Chief

Executive of a major Public Relations company. He has served as Human Resource Director of two

other quoted companies during his long and successful career.

James has a Master of Arts degree in Human Resources and Sociology.

James chairs both the Audit and Remuneration Committees.

Sunny Tang – Non-executive Director

Sunny has no experience of the oil industry but has been a successful Finance Director for two media

companies for over twenty years.

He is a qualified accountant and has been a Non-executive Director of Slide for two years.

He sits on both the Nomination and Remuneration Committees.

Anne Taylor – Non-executive Director

Anne Taylor has been a Non-executive Director since 2013. She has a background in human resource

management and has held senior managerial positions with a number of companies in a variety of

industries.

Anne sits on both the Nomination and Remuneration committees.

Sanje Lee – Non-executive Director

Sanje Lee has been a Non-executive Director since 2011. He has had a long career in the petroleum

industry. He served as Director of Technical Operations in Fouce for five years before Fouce asked him

to become a Non-executive Director of Slide.

Sanje moved to Kayland upon his appointment as a Non-executive Director.

Sanje has a Master of Science degree in Petroleum Technology and a Master of Business

Administration degree.

Sanje sits on both the Audit and Remuneration Committees.

Dina Viraj – Non-executive Director

Dina has been a Non-executive Director since 2010. She was previously on the Board of Fouce, and

has been selected by Fouce to be a Non-executive Director of Slide. Dina has a Doctorate in Oil and

Gas Geology and worked in the field for 15 years.

Dina moved to Kayland upon her appointment as a Non-executive Director. Strategic case study exam

– May 2015 – pre-seen materials

18 ©CIMA 2015. No reproduction without prior consent

Directors’ remuneration

The Remuneration Committee comprises James Peterson, Sunny Tang, Anne Taylor and Sanje Lee.

The committee met six times during the financial year ended 31 December 2014.

All Executive Directors receive an annual salary that is intended to be competitive in order to attract

and retain suitable Board members. The salary level is decided by the Remuneration Committee,

taking account of each individual’s role and experience and the comparable rates offered for

equivalent positions. Annual salary increases are generally in line with those offered to employees in

general, although there is scope for a more substantial increase in order to reflect any additional

responsibilities.

Executive Directors also participate in an annual bonus scheme, again administered by the

Remuneration Committee. The total bonus payable is capped at 100% of annual salary. The actual

level of bonus awarded is determined by a combination of collective and individual factors.

The collective factors are based upon achievement as measured in terms of Slide’s key KPIs:

Exploration targets, such as meeting drilling targets

Development and production targets

Health and safety

The remainder of the bonus is based on each Director’s achievement of personal objectives, as

relevant to his or her role in the business.

The KPI targets associated with bonuses are specified at the beginning of each year and are

communicated to the Board. A sliding scale is applied to each element of the KPI targets, linked to

actual success in achieving targets.

The annual bonus is paid at the conclusion of each financial year. Bonuses can be clawed back for up

to two years in the event of specific conditions such as the discovery of a material error in the figures

upon which performance was assessed.

There is also a long-term incentive scheme for Executive Directors. This is also administered by the

Remuneration Committee. An amount of up to 300% of annual salary can be awarded in respect of

exceptional performance. In this context, ‘exceptional’ is defined in terms of the same measures as

the annual bonus, but with more demanding criteria, which are also predetermined at the start of

each year and communicated to the Directors. The long-term incentive takes the form of shares and

share options that are granted at the end of each year, but which do not vest until three years have

passed. Any unvested awards lapse when a Director leaves the company.

The Non-executive Directors receive an annual fee for their services, along with an additional fee for

participating in any Board committees. The level of fee is set at a level that attracts and retains good

people.

Sanje Lee and Dina Viraj do not receive any fees or salaries from Slide. Their remuneration is both

determined by and paid by Fouce.

Comments

Page 1 out of 4

Viewing questions 1-10 out of 45

page 2