Question 1

A company is planning to repurchase some of its shares. Relevant details are as follows:

• 100 million shares in issue

• Current share price $5

• 5 million shares to be repurchased

• 10% repurchase premium

• Repurchased shares to be cancelled

What would you expect the share price after the repurchase to be?

Give your answer to two decimal places.

$ ?

- A. 4.97, 4.98

- B. 4.97, 3.98

Answer:

A

Comments

Question 2

Hospital X provides free healthcare to all members of the community, funded by the central

Government.

Hospital Y provides healthcare which has to be paid for by the individual patients. It is a listed

company, owned by a large number of shareholders.

In comparing the above two organisations and their objectives, which THREE of the following

statements are correct?

- A. X is a not-for-profit organisation while Y is a for-profit organisation.

- B. X and Y have the same primary financial objective - to maximise shareholder wealth.

- C. The performance of X will be appraised primarily on the basis of value for money.

- D. Only Y is likely to have a mixture of financial and non-financial objectives.

- E. X and Y will have the same primary non financial objective - provision of quality of health care.

Answer:

E

Comments

Question 3

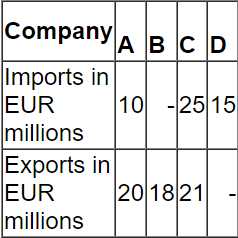

Companies A, B, C and D:

• are based in a country that uses the K$ as its currency.

• have an objective to grow operating profit year on year.

• have the same total levels of revenue and cost.

• trade with companies or individuals in the eurozone. All import and export trade with companies

or individuals in the eurozone is priced in EUR.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

- A. Company A

- B. Company B

- C. Company C

- D. Company D

Answer:

B

Comments

Question 4

A company has a cash surplus which it wishes to distribute to shareholders by a share repurchase

rather than paying a special dividend.

Which THREE of the following statements are correct?

- A. The payment of a special dividend could raise shareholders' expectations of similar distributions in the future, unlike a share repurchase.

- B. The share repurchase could send a negative signal to shareholders as it could be interpreted as a failure of management to find suitable investment opportunities.

- C. Determination of the repurchase price will be easy as shareholders will insist on receiving the open market price.

- D. Different tax regimes could result in shareholders having a preference for a share repurchase due to the often more preferential tax treatment of capital gains.

- E. The share repurchase, if approved by the shareholders, will be binding on all of the company's shareholders.

Answer:

A, B, D

Comments

Question 5

A company's gearing (measured as debt/(debt + equity)) is currently 60% and it is investigating

whether an optimal gearing structure exists within the industry.

It has analysed the capital structure of similar companies in the industry and it would appear that

there is evidence supporting the traditional theory of capital structure.

Companies with the lowest WACC in the industry have gearing of around 45% to 50%.

Which of the following actions would result in the company achieving a more optimal capital

structure?

- A. Undertaking a rights issue of equity to repay some of its debt.

- B. Refinancing to replace some of its short term debt with long term debt.

- C. Increasing the level of dividend to return more cash to shareholders.

- D. Using retained cash to undertake a buyback of some of its equity.

Answer:

A

Comments

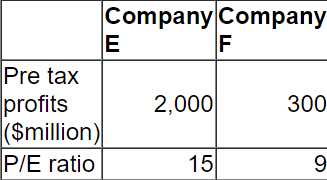

Question 6

Company E is a listed company. Its directors are valuing a smaller listed company, Company F, as a

possible acquisition.

The two companies operate in the same markets and have the same business risk.

Relevant data on the two companies is as follows:

Both companies are wholly equity financed and both pay corporate tax at 30%.

The directors of Company E believe they can "bootstrap" Company F's earnings to improve

performance.

Calculate the maximum price that Company E should offer to Company F's shareholders to acquire

the company.

Give your answer to the nearest $million.

- A. 3,150

- B. 1,890

- C. 4,500

- D. 2,700

Answer:

A

Comments

Question 7

A company plans to acquire new machinery.

It has two financing options; buy outright using a bank loan, or a finance lease.

Which of the following is an advantage of a finance lease compared with a bank loan?

- A. It is "off-balance sheet" and will not affect the company's gearing.

- B. The interest rate offered might be more favourable because the lessor has the security of the asset.

- C. Tax depreciation allowances may be passed on to the company by the lessor.

- D. The lessor provides maintenance of the asset.

Answer:

B

Comments

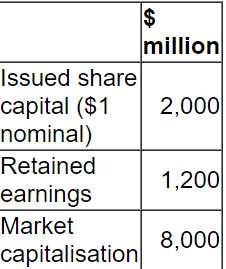

Question 8

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt

covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

- A. Retained earnings

- B. Private placement of a bond

- C. Rights issue

- D. Bank overdraft

Answer:

C

Comments

Question 9

Company A is a listed company that produces pottery goods which it sells throughout Europe. The

pottery is then delivered to a network of self employed artists who are contracted to paint the

pottery in their own homes. Finished goods are distributed by network of sales agents.The directors

of Company A are now considering acquiring one or more smaller companies by means of vertical

integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the

stated aim of vertical integration?

- A. A company in a similar market to Company A.

- B. A pottery factory in the Middle East.

- C. A company that produces accessories.

- D. A listed international logistics firm.

Answer:

D

Comments

Question 10

A company has just received a hostile bid. Which of the following response strategies could be

considered?

- A. Revalue non-current assets

- B. Poison pill strategy

- C. Change the Articles of Association to amend voting rights

- D. Approach a White Knight

Answer:

D

Comments

Page 1 out of 39

Viewing questions 1-10 out of 391

page 2