Question 1

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of

static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal

which is proving to be successful.

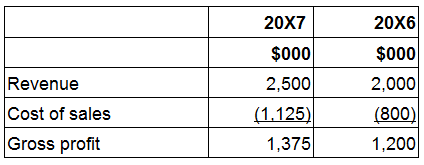

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of

KL?

- A. A worldwide shortage of leather resulting in increased prices from suppliers.

- B. The opportunity to sell handbags in the airport store at a premium price.

- C. KL locating a new supplier prepared to supply handbags at a cheaper price.

- D. KL locating a new supplier closer to the warehouse, reducing distribution costs.

Answer:

A

Comments

Question 2

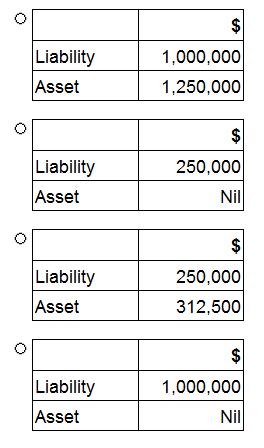

The following information relates to DEF for the year ended 31 December 20X7:

• Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of

$2,500,000.

• There are unused tax losses to carry forward of $1,250,000. These tax losses have arisen due to

poor trading conditions which are not expected to improve in the foreseeable future.

• The corporate income tax rate is 25%.

In accordance with IAS 12 Income Taxes, the financial statements of DEF for the year ended 31

December 20X7 would recognise deferred tax balances of:

- A. Option A

- B. Option B

- C. Option C

- D. Option D

Answer:

A

Comments

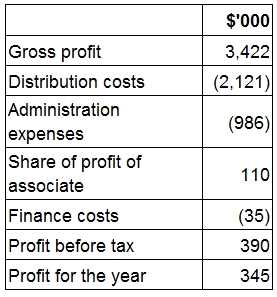

Question 3

At 31 October 20X1 RS has in issue 10% debentures 20X8 with a carrying value of $350,000.

Extracts from its statement of profit or loss for the year ending 31 October 20X7 are as follows:

What is the interest cover for RS for the ended 31 October 20X7?

- A. 9.0 times

- B. 11.1 times

- C. 10.0 times

- D. 8.0 times

Answer:

A

Comments

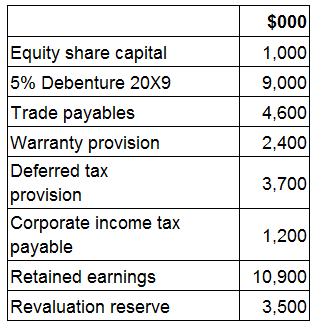

Question 4

CORRECT TEXT

Information extracted from JK's statement of financial position for the year ended 31 May 20X5 is as

follows:

Calculate the gearing ratio (Debt/Equity measured as a percentage) at 31 May 20X5.

Give your answer to one decimal place.

? %

Answer:

58.4, 58,

58.44, 59, 58.5, 58.0

Comments

Question 5

EFG is preparing its financial statements to 31 March 20X8. During the year ended 31 March 20X7,

EFG purchased a piece of land for $1 million which is used as the staff car park. EFG has a policy of

revaluing land, in accordance with International Accounting Standards, and at 31 March 20X8,

accounted for a substantial increase in its value.

Revenue and operating profit has remained constant over the 2 years.

When comparing EFG's financial statements for the year ended 31 March 20X7 with those of 20X8,

which THREE of the following would be expected?

- A. Increase in profit before tax.

- B. Increase in other comprehensive income.

- C. Increase in return on capital employed.

- D. Decrease in return on capital employed.

- E. Increase in net asset turnover.

- F. Decrease in net asset turnover.

Answer:

B, D, F

Comments

Question 6

BC are currently seeking to establish an accounting policy for a particular type of transaction.

There are four alternative ways in which this transaction can be treated. Each treatment will have a

different outcome on the financial statements as follows:

• Treatment one means that the financial statements will be easier to prepare.

• Treatment two will give a fair representation of the transaction in the financial statements.

• Treatment three will maximise the profit figure presented in the financial statements.

• Treatment four means that the financial statements will be more easily understood by

shareholders.

Which accounting treatment should BC adopt?

- A. One

- B. Two

- C. Three

- D. Four

Answer:

B

Comments

Question 7

LM has made the following share purchases during the year:

• Purchased 55% of the equity share capital of OP.

• Purchased 45% of the equity share capital of QR. LM have the power to appoint the majority of

board members on the QR board.

• Purchased 30% of the equity share capital of ST. LM is represented by one director on the main

board of ST which has five members in total. The other 70% of ST's equity share capital is owned by a

single company, UV.

The Managing Director has told you that OP has performed well, but both QR and ST have not

performed as expected. He is therefore pleased that OP will be included as a subsidiary and that QR

and ST will only be included as investments in the group financial statements.

In accordance with the ethical principle of professional competence and due care how should the

investments in OP, QR and ST be treated in the group financial statements?

- A. OP and QR should be consolidated and ST should be equity accounted.

- B. OP should be consolidated and QR and ST should be equity accounted.

- C. OP should be consolidated, QR should be equity accounted and ST should be valued at cost.

- D. OP and QR should be equity accounted and ST should be valued at cost.

Answer:

A

Comments

Question 8

LM are just about to pay a dividend of 20 cents a share. Historically, dividends have grown at a rate of

5% each year.

The current share price is $3.05.

The cost of equity using the dividend valuation model is:

- A. 12.4%

- B. 11.9%

- C. 7.4%

- D. 6.9%

Answer:

A

Comments

Question 9

KL issued $100,000 of 6% convertible debentures at par on 1 January 20X7. These debentures are

redeemable at par or can be converted into 5 shares for each $100 of nominal value of debentures

on 31 December 20X9.

The share price on 1 January 20X7 is $18 a share. The share price is expected to grow at a rate of 7%

a year.

The expected redemption value for each $100 nominal value of debentures on the date of conversion

is:

- A. $110.25

- B. $103.04

- C. $100.00

- D. $90.00

Answer:

A

Comments

Question 10

JK is seeking to raise new finance through a rights issue of equity shares.

Which THREE of the following statements are correct?

- A. The administration costs associated with a rights issue are higher than those for an initial public offering.

- B. Shareholders must pay the full market price for shares offered in a rights issue.

- C. An alternative name for a rights issue is a scrip issue of shares.

- D. A rights issue will dilute an existing shareholder's control of the entity if they do not take up their rights.

- E. Entities have the opportunity to underwrite a rights issue.

- F. Shareholders' entitlement to rights may be sold on their behalf.

Answer:

D, E, F

Comments

Page 1 out of 26

Viewing questions 1-10 out of 268

page 2