Question 1

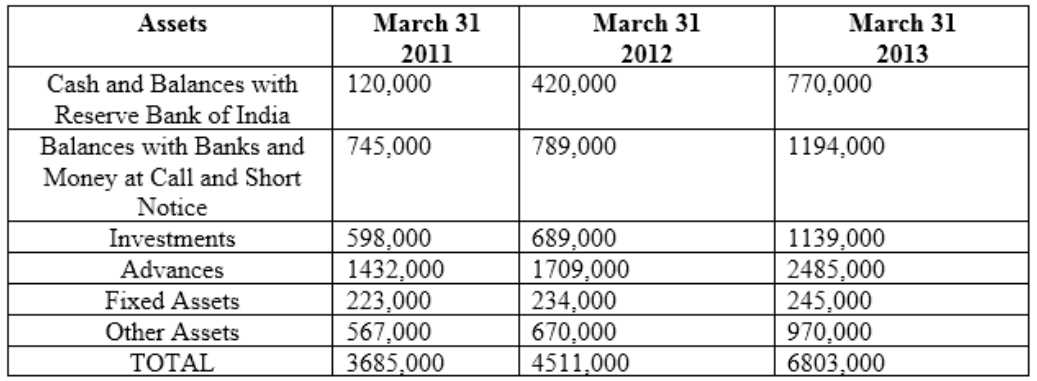

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across Indi

a. The bank has been in business since 1971 and has about 40% branches in rural areas and about

75% of all branches are in

Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks

in India.

Although top management has appointment period of 5 years, generally they retire on ach sieving

age of 60 years with an average tenure of only 2 years at the top job.

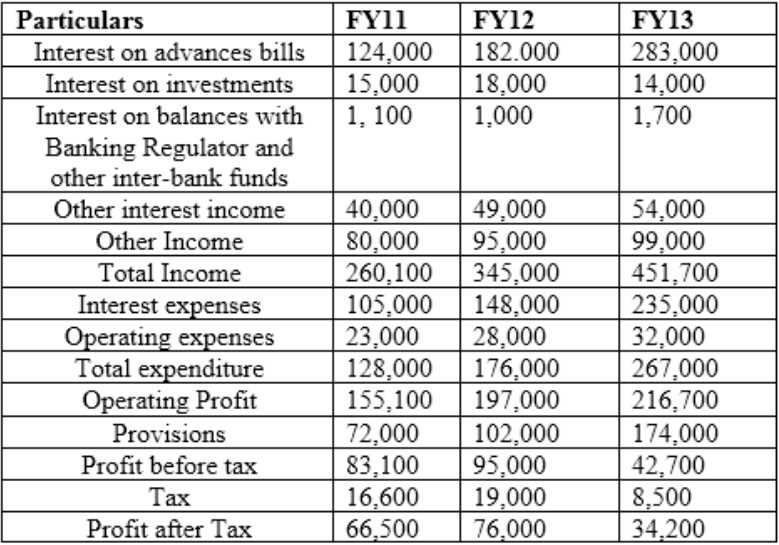

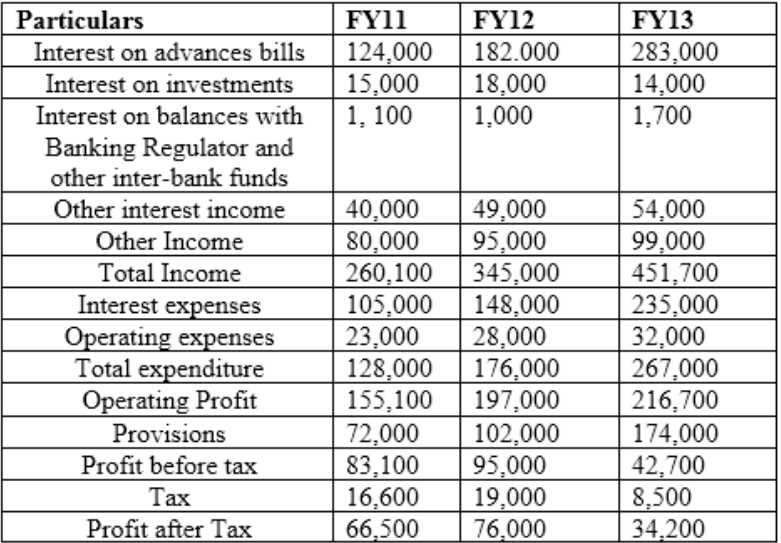

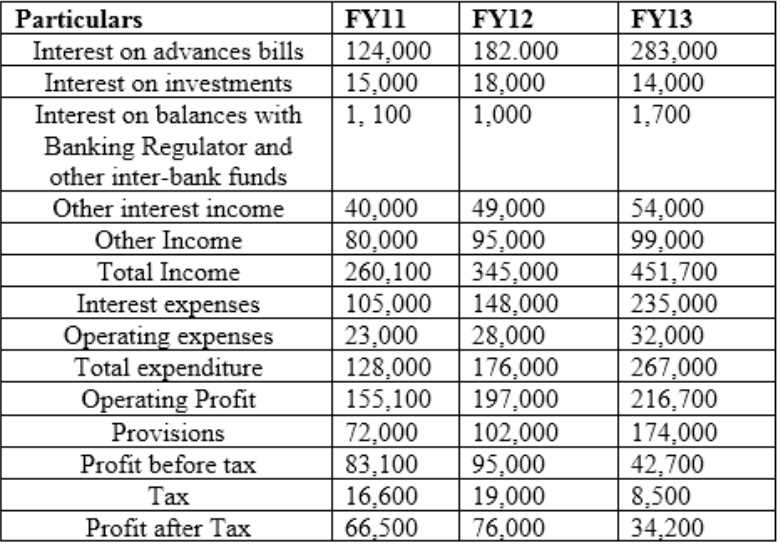

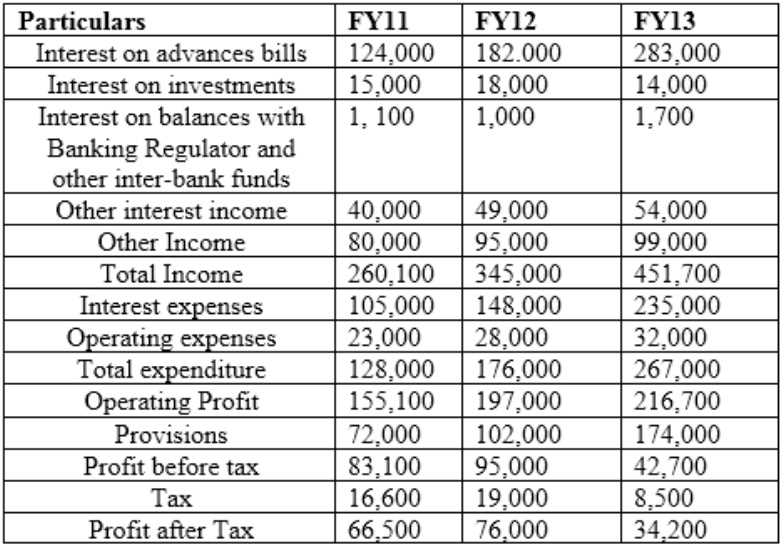

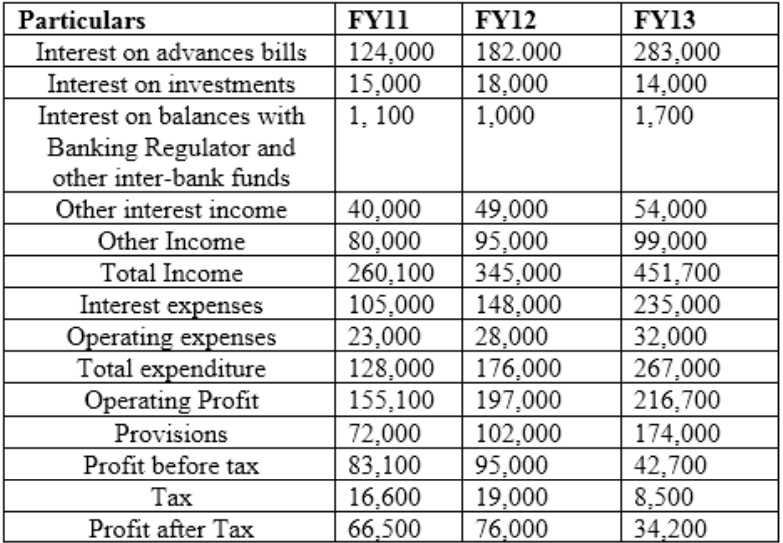

Profit and Loss Account

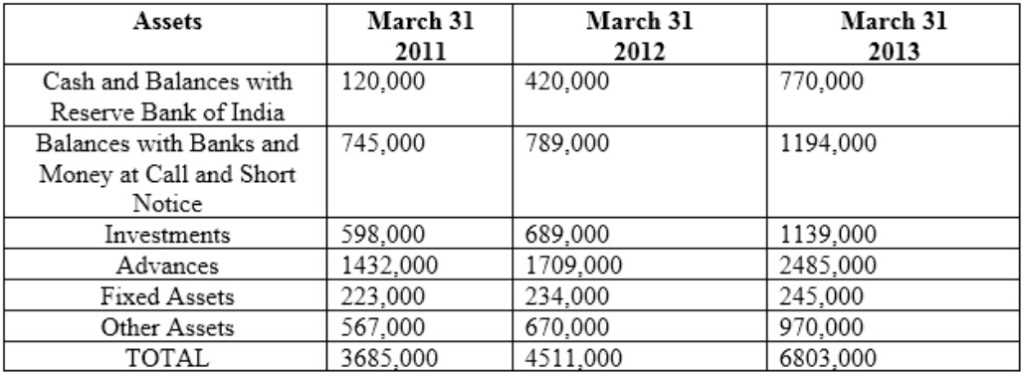

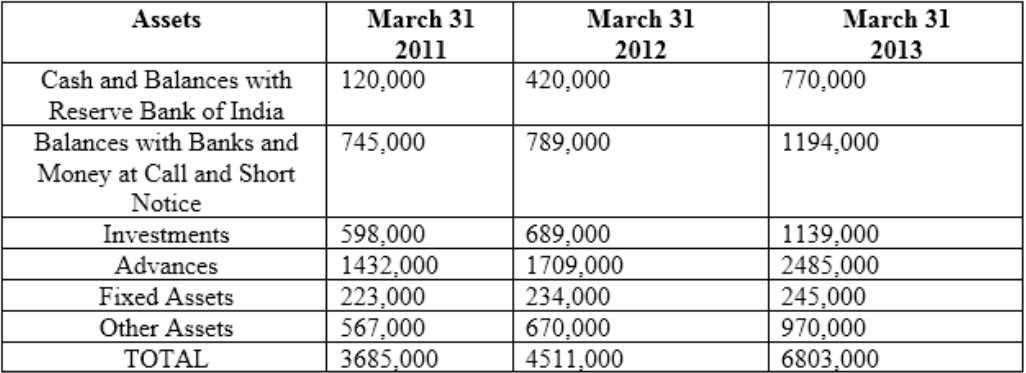

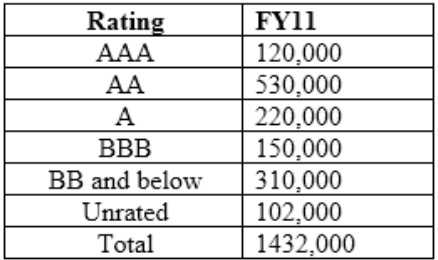

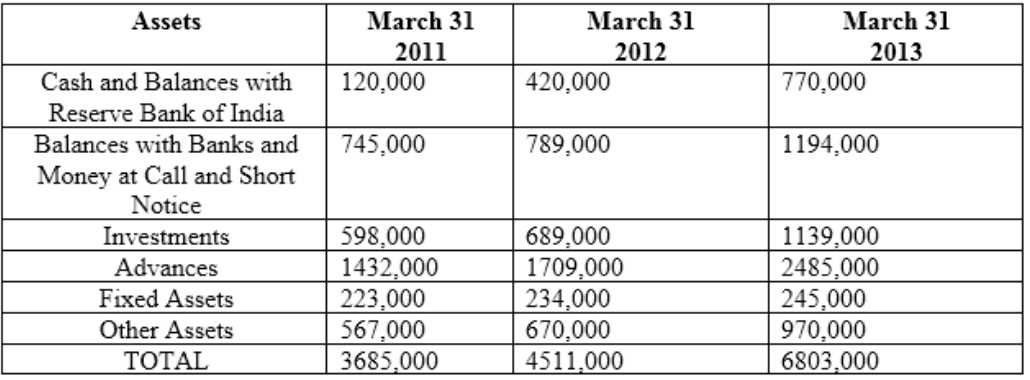

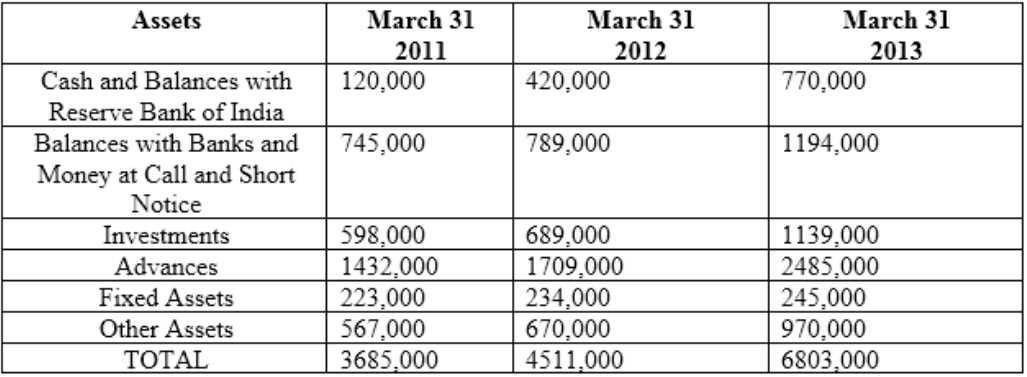

Balance Sheet

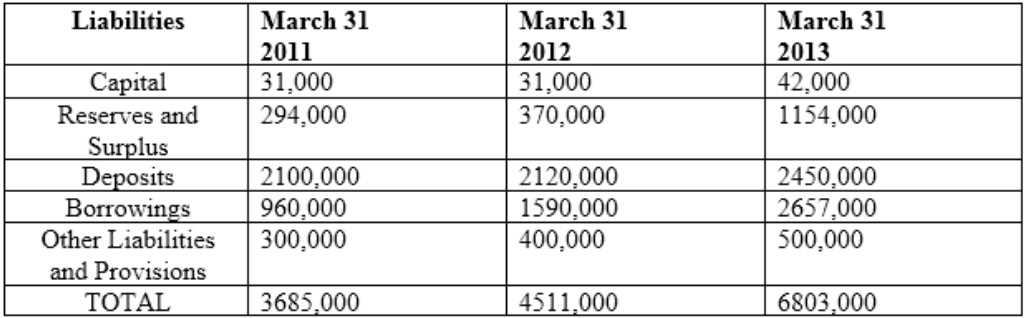

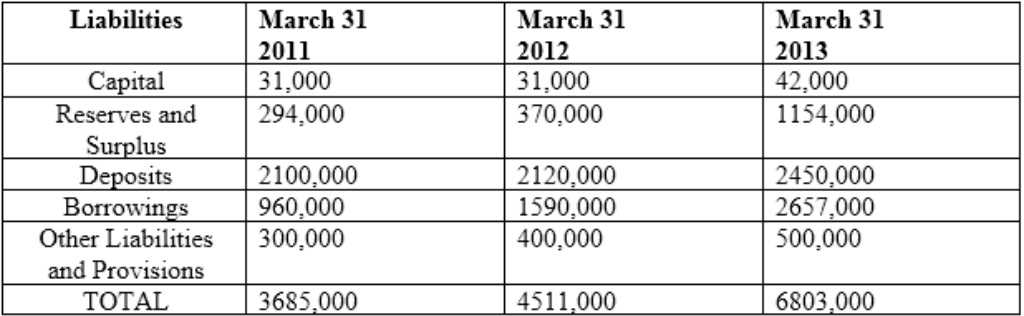

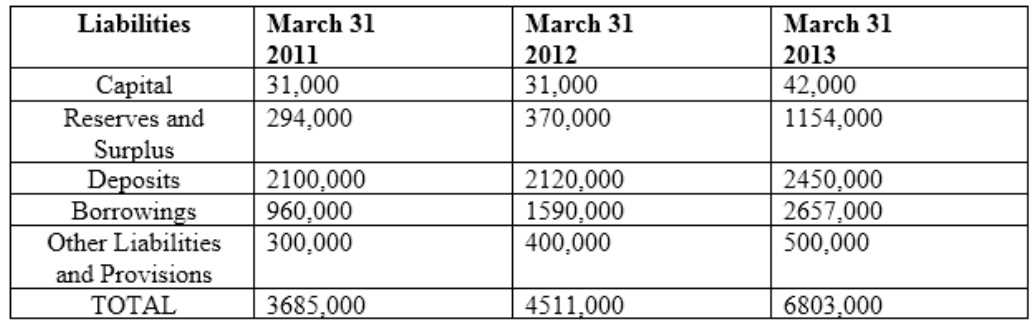

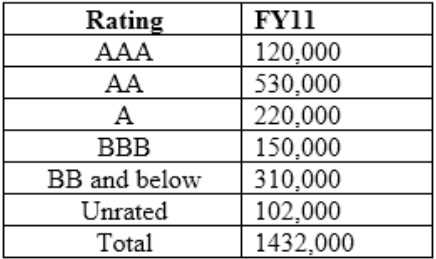

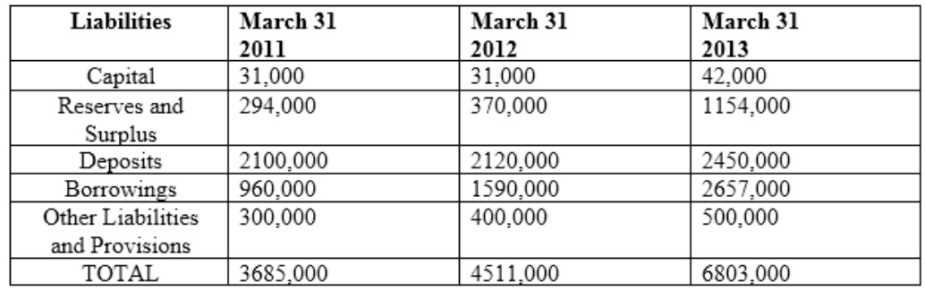

The rating wise break-up of assets for FY11 is as follows:

The core spreads for FY13 as compared to FY12 have:

- A. Expanded by 136 bps

- B. Contracted by 327 bps

- C. Contracted by 136 bps

- D. Expanded by 191 bps

Answer:

C

Comments

Question 2

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across Indi

a. The bank has been in business since 1971 and has about 40% branches in rural areas and about

75% of all branches are in

Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks

in India.

Although top management has appointment period of 5 years, generally they retire on ach sieving

age of 60 years with an average tenure of only 2 years at the top job.

Profit and Loss Account

Balance Sheet

The rating wise break-up of assets for FY11 is as follows:

The ROTA for Auckland deteriorated from ___in FY12 to___ in FY13.

- A. 0,.7%, 0,3%

- B. 7%; 2%

- C. 2.3%; 0.7%

- D. 1.9%; 0.6%

Answer:

C

Comments

Question 3

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across Indi

a. The bank has been in business since 1971 and has about 40% branches in rural areas and about

75% of all branches are in

Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks

in India.

Although top management has appointment period of 5 years, generally they retire on ach sieving

age of 60 years with an average tenure of only 2 years at the top job.

Profit and Loss Account

Balance Sheet

The rating wise break-up of assets for FY11 is as follows:

Cost to income ratio is best for which year

- A. FY13

- B. FY11

- C. Same FY11 and FY12

- D. FY12

Answer:

A

Comments

Question 4

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across Indi

a. The bank has been in business since 1971 and has about 40% branches in rural areas and about

75% of all branches are in

Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks

in India.

Although top management has appointment period of 5 years, generally they retire on ach sieving

age of 60 years with an average tenure of only 2 years at the top job.

Profit and Loss Account

Balance Sheet

The rating wise break-up of assets for FY11 is as follows:

Computer risk weighted assets for Auckland Ltd for FY11:

- A. 10,10,000 Million

- B. 13,24,500 Million

- C. 11,64,500 Million

- D. 11,60,000 Million

Answer:

C

Comments

Question 5

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across Indi

a. The bank has been in business since 1971 and has about 40% branches in rural areas and about

75% of all branches are in

Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks

in India.

Although top management has appointment period of 5 years, generally they retire on ach sieving

age of 60 years with an average tenure of only 2 years at the top job.

Profit and Loss Account

Balance Sheet

The rating wise break-up of assets for FY11 is as follows:

During which year amongst the three, was the overall financial profile of bank most string?

- A. No change in three years

- B. FY13

- C. FY11

- D. FY12

Answer:

B

Comments

Question 6

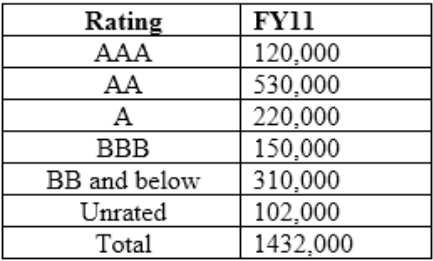

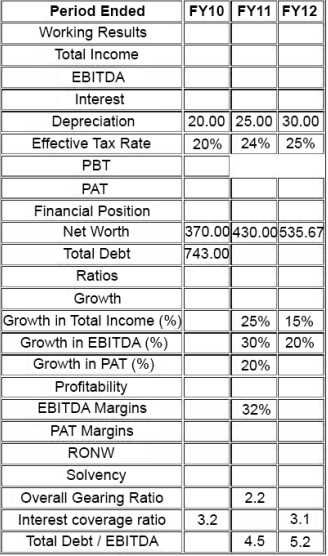

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client,

FlyHigh

Airlines Ltd, a company operating chartered aircrafts in Indi

a. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of

prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could

recollect few numbers from her memory and reconstructed following partial financial table:

An analyst comparing two competitors Comp Systems and Big Tables gathers the data below:

Cash Conversions Cycle:

Comp Systems: 18 days and Big Tables 32 days

Defense Interval Ratio:

Comp Systems: 50 and Big Tables: 20

What can the analyst conclude regarding the liquidity of these companies?

- A. Both indicators suggest that Comp Systems is more liquid than Big Tables

- B. Both indicators suggest that Big Tables manages it/s cash better than Comp Systems

- C. Both indicators give contradictory results

- D. While Comp Systems is more liquid as per the Cash conversion cycle, Big Tables manages its cash better as indicated by a lower, hence better Defense Ratio

Answer:

C

Comments

Question 7

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client,

FlyHigh Airlines Ltd, a company operating chartered aircrafts in Indi

a. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of

prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could

recollect few numbers from her memory and reconstructed following partial financial table:

What is Total Income FY10 and FY12?

- A. FY10: INR400 Million; FY12:INR575 Million

- B. FY10: INR525.56 Million; FY12: INR755.49 Million

- C. Insufficient Information to compute

- D. FY10: INR656.94 Million; FY12: INR821.18 Million

Answer:

A

Comments

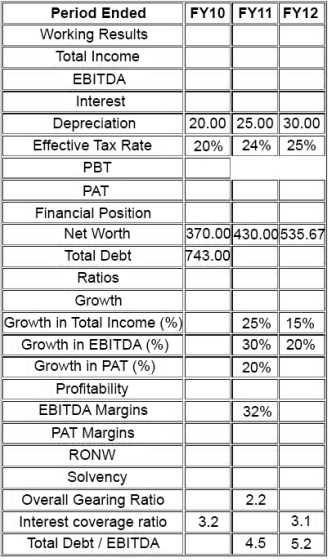

Question 8

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client,

FlyHigh

Airlines Ltd, a company operating chartered aircrafts in Indi

a. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of

prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could

recollect few numbers from her memory and reconstructed following partial financial table:

Compute growth in PAT for FY12?

- A. 25%

- B. 19%

- C. 22%

- D. 21%

Answer:

A

Comments

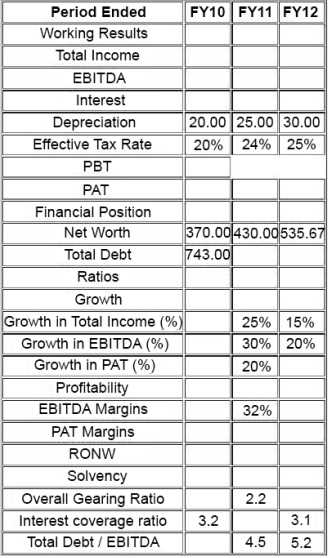

Question 9

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client,

FlyHigh

Airlines Ltd, a company operating chartered aircrafts in Indi

a. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of

prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could

recollect few numbers from her memory and reconstructed following partial financial table:

PAT margins are highest in which of the years?

- A. FY12

- B. FY11

- C. FY10

- D. Equal in FY10 and FY12

Answer:

A

Comments

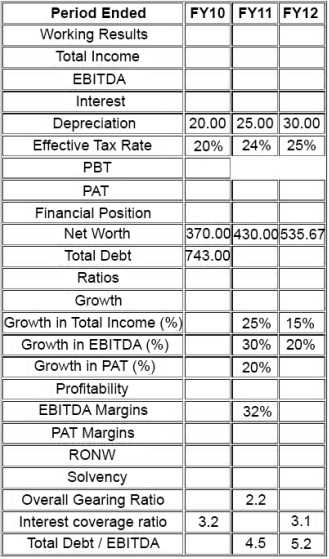

Question 10

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client,

FlyHigh

Airlines Ltd, a company operating chartered aircrafts in Indi

a. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of

prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could

recollect few numbers from her memory and reconstructed following partial financial table:

Compute Interest for FY10 and FY12?

- A. Insufficient Information to compute

- B. FY10: INR50.53 Million; FY12:INR81.38 Million

- C. FY10: INR161.71 Million; FY12: INR252.27 Million

- D. FY10: INR17.47 Million; FY12:INR782.03 Million

Answer:

c

Comments

Page 1 out of 8

Viewing questions 1-10 out of 84

page 2